Funds Global MENA “Urgently Wanted: Asset Managers”

01/09/2011

Gulf Fixed Income Markets – Poised for Growth

Michael P. Grifferty

The Arabian Gulf fixed income market has made remarkable advances and the potential for further growth is enormous, but it has to be supported by a robust asset management industry to reach its potential.

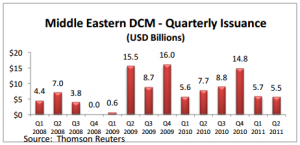

In line with a global emerging market trend, 2010 and 2011 have been significant years for bonds originating from the Gulf with an unprecedented variety of issuers ranging from sovereigns to government-related entities to banks and high yield corporates. Global investors are trending positive on the region and paying attention to the volume and frequency of issuance. The onset of the Arab Spring in the first quarter caused a number of issues to be put on hold, with volume picking up quickly when markets stabilized for a period before the summer lull. There is reason to believe that the region can supply considerable issuance in the fourth quarter of 2011, provided advanced market debt problems do not spin out of control. Forecasting volumes can be tricky as regional issuers tend to access the market opportunistically leading to bunching when windows of opportunity open. Names closely associated with highly rated Abu Dhabi and Qatar are likely to keep holding investors’ attention.

Refinancing will be a key driver as companies look to extend their maturity profiles to address risk and lock in low dollar interest rates. With corporate indebtedness skewed towards bank debt and banks risk averse, bond issuance may be more out of necessity, than love for the rigors of the market. Banks themselves can be attracted in provided the pricing is attractive. This seems to be borne out by the number of bank issues that have hit the market (First Gulf Bank, HSBC, Sharjah Islamic Bank) and are in pipeline (Al Hilal Bank, Qatar National Bank, Commercial Bank of Qatar, Al Baraka). Looking further out, issuance may also be supported by the willingness of surplus-generating states to pursue counter-cyclical fiscal policies and fund ambitious capital plans

Domestic bond markets, however, remain stunted. In the past some states had run regular issuance programs, but much of this indebtedness has been drawn down leaving markets starved of supply. Since the global financial crisis there has been a growing recognition that local currency yield curves provide critical mass for development of indigenous markets and that developed markets could have helped absorb the shock. Central banks appreciate the need for a curve, but are unlikely to issue securities beyond a year without the fiscal authority as obligor. Positive steps include the establishment of emirate and federal debt management offices in UAE and periodic issuances by Qatar. However, in conditions of fiscal surplus, it can be difficult to garner will to incur direct government debt

What has not been universally taken on board is that the respective national economies are not sufficient to support a diverse, liquid market and that coordination among the states on market design and infrastructure is essential to minimize risk of fragmentation. Having said that, early steps towards harmonizing procedures for bond issuance are being taken, warmly supported by the industry. Working through the GCC, the states should be able to create over time, a common, streamlined framework within which the sovereigns and their companies can issue. But, for the time being, the international capital markets are where the majority of capital will be raised

Strong Base Needed

Within the region, the largest set of buyers remains commercial bank treasuries. But since the majority of GCC bonds are issued in USD in international markets, it comes as no surprise that a majority of the buyers are outside of the region. Choice of market reflects that potential regional demand has not yet been harnessed. If the Gulf region is to begin to fund more of its own development via the debt markets, then it will need to stimulate an institutional investor base, starting with providing a framework for world class asset management.

Given the concentrations of wealth in the region, it is somewhat puzzling why the Gulf does not figure in international road shows for US, European and Asian companies raising capital. Less so if you consider that the states ensure their citizens’ well-being through various channels with the result that development of private savings has remained on the back burner. Sovereign wealth funds are mainly outwardly focused and do not (with exceptions) support the local markets. Likewise, in spite of the wealth resident in the region, the Gulf has not developed its potential as a center for asset management, though at least three jurisdictions, Dubai, Bahrain and Qatar, are vying for that role. The paucity of mutual funds in the region derives in part from the small size of its capital markets, lack of available hedging tools and from the relatively short time horizons of the local investors. Further, many high net worth individuals use professional asset management to access international markets but are comfortable dealing directly on the domestic bourses. The number of locally managed fixed income funds has increased over the past two years, but remains very modest by any comparison.

But it is regulation that may play the decisive role in determining whether asset management really takes off in the region. The past months have seen the spotlight cast on the funds environment as regulatory upgrades have been unrolled in UAE and Kuwait. While market participants are quite concerned over aspects of the respective regulations that seem to emphasize investor protection at the expense of market development, the regulators have engaged in a real two-way dialogue with industry representatives, hopefully setting a new standard. Indications are that industry concerns are being taken into account. Further enhancements to the regulatory environment could provide for needed capabilities to accompany bond liquidity such as futures and swaps markets, repo markets and securities lending to facilitate investors constructing their portfolios and risk management strategies

A fundamental challenge for asset management is the lack of an incentive structure to foster private long term savings. Pension systems tend towards state operated defined benefit schemes operating on a pay-as-you-go basis. Social security retirement funds cover state employees, but investment policies can be opaque. The insurance sector is growing rapidly, though from a very low base. With the bulk of policies being non-life, insurer investment horizons are correspondingly short. While cultural mores are often cited, the sector’s underdevelopment is as much due to regulatory regimes that allow insurers to invest beyond prudent norms in volatile property and stock markets. Efforts are underway to improve the environment for insurance including by establishing dedicated oversight bodies and upgrading regulation.

Disclosure and Investor Relations

Gulf corporates, long criticized for lack of transparency, had to respond positive when the financial crises of the past years raised the disclosure bar for access to international markets. A survey by The Gulf Capital Market Association (GCMA) revealed that a majority of investors have become more demanding over the past two years and that an overwhelming majority feel that good investor relations (IR) can lead to more aggressive pricing. Most investors in Gulf bonds still consider the information provided to be insufficient and those that had met issuers on roadshows were often not satisfied with the quality of information provided. Investor relations offices had been mainly oriented to satisfying equity investors but there is growing attention to the needs of debt investors. GCMA plans to release a set of Debt IR guidelines specifically meant for Gulf issuers to benchmark against.

Consensus and Commitment – Taking Shape

The case for deepening the GCC bond markets has never been more urgent or better understood. But getting there implies a regional consensus vision accompanied by an organized commitment from governments, central banks, regulators and the GCC, with cooperation from the industry. A central part of that commitment has to include stimulating an investor base served by world class asset management.

Michael Grifferty is the President of The Gulf Capital Market Association, the organization representing the Arabian Gulf fixed income market. www.gulfbondsukuk.org; info@gulfcapitalmarket.org