GCMA 2019 Debt Capital Market Summit

13/10/2019

3rd Gulf Debt Capital Market Summit

The Summit presentation is available here.

The Event Program is available for download!

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants

for the 3rd Gulf Debt Capital Market Summit on the 25th of November 2019.

Venue: The Address Boulevard, Downtown Dubai. (See here for directions.)

- Will the progress in Egypt be sustained?

- What are regulators thinking about the latest innovations?

- How is the Middle East securing its place in global sustainable finance?

- Where are the next Green Sukuk coming from?

- Does Technology have the power to transform the sukuk capital market?

- What is the outlook for Gulf credits and funding in 2020?

- Do Gulf credits still offer enough spread to generate full order books?

- Is geopolitical risk properly priced in?

- Can strong national balance sheets make up for slower growth?

- Will reforms and support ensure Bahrain and Oman access to finance?

Speakers:

Bryan Stirewalt

Chief Executive, Dubai Financial Services Authority

Dr. Mounther Barakat

Senior Financial Markets Advisor, UAE Securities and Commodities Authority

Richard Teng

CEO, Financial Services Regulatory Authority – Abu Dhabi Global Market

Omar Zaineddine

Head of Debt Capital Markets, KAMCO Investment Company

Fawaz Abdulnour

Officer-in-charge – Crowd Engagement & External Funds Management,

Islamic Development Bank

Abdullah Elhor

Project Manager, Arab Monetary Fund

John Arentz

Head of Treasury, MAF Holding

Timucin Engin

Senior Director and Cross-Practice Country Coordinator GCC region, S&P Global Ratings

Khalid Howladar

Managing Director, Acreditus

Dyan Kannangara

Director, Debt Capital Markets, Emirates NBD Capital

Bashar Al Natoor

Global Head of Islamic Finance, Fitch Ratings

Barbara Riccardi

Managing Director, Natixis

Zeina Rizk, CFA

Director, Fixed Income Asset Management, Arqaam Capital

Alex Roussos

Partner, Dentons

Mohammed AlSehli

Co-founder and CEO, Wethaq Capital Markets

Adrianus Schoorl

Partner, White & Case

Fawaz Abu Sneineh

Managing Director, Head of Debt Capital Markets & Issuer Services – First Abu Dhabi Bank

Talal Tabbaa

Co-founder and Chief Operating Officer, Jibrel Network

Anita Yadav

Chief Executive Officer, Century Financial

Vice Chair, Gulf Bond and Sukuk Association (GCMA)

For speaker biographies click here

This event is complimentary to GCMA members. RSVP via events@gulfbondsukuk.org

Non-members wishing to attend can inquire via info@gulfcapitalmarket.org

Platinum Partner

Gold Partners

Lanyard Partner

Technology is reshaping the way financial markets operate and the Middle East will be no exception. Join us for an exclusive meeting of market practitioners and technologists who will drill down into how Blockchain can transform the lifecycle of securities through the primary, secondary and collateral markets.

The Gulf Capital Market Association invites members to take part in an interactive workshop with leading industry practitioners to explore Blockchain adoption in the Middle East Capital Market.

Workshop topics:

. Which areas are ripe for transformation?

. How can the technology be applied to support local markets?

. Can new investors be attracted?

. How does the regulatory environment support or inhibit?

. What will it take for key players to buy in?

This event may be of particular interest to:

Corporate Issuers; Investment Officers; Wealth Managers; Compliance Officers; Legal Advisors; Service Providers; Regulators

Speakers list:

Dr. Mohamed Damak (Global Head of Islamic Finance, S&P Global Ratings)

Evans Munyuki (Group Chief Digital Officer, Emirates-NBD)

Talal Tabbaa (Co-Founder and Chief Operating Officer, Jibrel Network)

Khalid Howladar (Managing Director and Founder, Acreditus)

Gregory Man (Partner, Norton Rose Fulbright)

Francois Tilly (Director, Unit Head Middle East & Africa, Euroclear)

EVENT DETAILS

July 23, 2019 – 8:30AM – 10:30AM (Light breakfast will be served)

Venue: Capital Club, Fifth Floor, Gate Village 3, DIFC, Dubai, UAE (View here for directions)

This event is complimentary to GCMA members who can reserve one of the limited places via events@gulfbondsukuk.org

Non-members wishing to attend can contact info@gulfcapitalmarket.org

NOTE: the Chatham Rule will apply for this event.

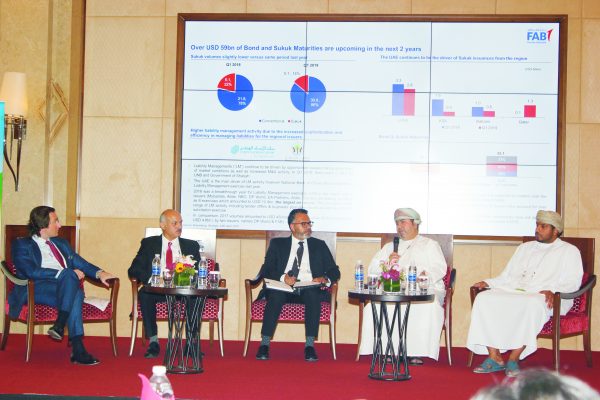

April 2019 GCMA Oman Debt Capital Markets Conference

16/04/2019

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants for the GCMA Oman Debt Capital Markets Conference in Muscat on the 29th of April 2019.

This is the only Oman focused conference created by the industry and presented with the cooperation of its official partners.

Hear directly from the regulators as well as key investors and issuers as they discuss:

- Economic outlook for Oman and the region

- Sources of new issuance pipeline in Oman and the region

- How will Oman companies and projects be financed in 2019 and beyond?

- What structures and products will attract investors?

- The latest on regulation and law impacting financing in Oman

- The credit outlook for 2019 and demystifying ratings for Oman companies

Confirmed speakers include:

Sohail Niazi

Chief Executive, Maisarah Islamic Banking – Bank Dhofar

Samra Al-Harthy

Senior Manager, Economic Research, State General Reserve Fund, Ministry of Finance, Sultanate of Oman

Anita Yadav

Senior Director, Head of Fixed Income Research, Emirates NBD

Samer Haydar

Associate Director, Fitch Ratings

Sadaf Buchanan

Partner, Dentons

Mohsin Shaik Bin Sehu Mohammed

Senior Executive Manager, Investment Banking and Capital Markets, Maisarah Islamic Banking – Bank Dhofar

Girish Koli

Chief Financial Officer, Al Madina Real Estate Co. SAOC

Ghassan Al-Hashar

Investment Director, Public Authority for Social Insurance

Giuseppe Ruggiero

Managing Director, Debt Capital Markets, First Abu Dhabi Bank

A full list of speakers and an agenda will be released shortly.

This event will be held at the Sheraton Oman Hotel, Ruwi, Muscat, Oman, and is complimentary to GCMA members.

Registration and light breakfast at 8:15AM.

Conference kick-off at 9:00AM – Closing at 1:00PM, followed by a networking lunch.

This event is complimentary to GCMA members who can reserve a place via events@gulfbondsukuk.org

Non-members wishing to attend can contact info@gulfcapitalmarket.org

Platinum Sponsor:

Gold Sponsors:

March 2019 GCMA Kuwait Debt Capital Markets Conference

27/02/2019

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants for the GCMA Kuwait Debt Capital Markets Conference in Kuwait on the 19th of March 2019.

This is the only Kuwait focused conference created by the industry and presented with the cooperation of its official partners.

A full list of speakers and an agenda will be released shortly.

Hear directly from key global and regional investors and issuers as they discuss:

- Economic Outlook for Kuwait and the Gulf region

- Global economic trends that are impacting the markets

- The new role of Environmental, Social and Governance factors in Gulf investing

- Latest developments in global and regional regulation

- The latest on financial sector consolidation

- Who will be issuing in 2019

- The ‘why, when and how’ of credit ratings

This event will be held at the JW Marriott – Kuwait City

Registration and light breakfast at 8:15AM.

Conference kick-off at 9:00AM – Closing at 1:00PM, followed by networking lunch.

This event is complimentary to GCMA members who can reserve a place via dvanhoutte@gulfbondsukuk.org

Non-members wishing to attend can contact events@gulfbondsukuk.org

Platinum Sponsor:

Gold Sponsor:

The Gulf Capital Market Association invites interested members to take part in a seminar and hear the viewpoints from key industry practitioners on aspects pertaining Environmental, Social, and Governance factors in contemporary Finance.

This collaborative event, held in cooperation with S&P Global Ratings, on January 17th 2019 is an excellent opportunity to meet ESG focused finance professionals and to share your insights.

The discussion will include a briefing, followed by an interactive session.

We invite active participation in a lunchtime discussion (11AM – 1PM) – (Light lunch served)

- In-person: at the offices of S&P Global Ratings in Dubai. (Level 5, Building 1, DIFC – See MAP)RSVP in advance via events@gulfbondsukuk.org

OR

- For Dial-in: conference participationContact us via info@gulfbondsukuk.org

Agenda:

- The Growing Importance of ESG In Fixed Income Markets

- How ESG Risks & Opportunities Factor into Credit Ratings

- Application of environmental, social, and governance factors into investing

- Raising capital for sustainable projects

- Communicating with ESG investors

- Next steps for ESG in Middle East fixed income

The seminar will include remarks from:

- Mike Wilkins, Managing Director and Head of Sustainable Finance, Corporate & Infrastructure Ratings, S&P Global Ratings

- Khaldoun Hajaj, Head Public Affairs & Sustainability Africa & Middle East, Standard Chartered Bank

- Nisarg Trivedi, Director – Middle East, Schroders

This event may be of particular interest to:

Corporate Issuers; Investment Officers; Wealth Managers; Compliance Officers; Legal Advisors; Service Providers; Regulators

Please note that for this event the Chatham rule will apply.

The Gulf Capital Market Association, in partnership with Fisch Asset Management and S&P Dow Jones Indices presents a breakfast seminar

The GCC’s shifting index landscape: what does it mean for issuers and investors?

The seminar presentation is now available!

Download the presentation: The GCC’s Shifting index landscape: what does it mean for issuers and investors?

Monday, 10 December 2018

8:30 AM – 10:30 AM

Capital Club, Dubai Room, Gate Village 3, DIFC, Dubai, UAE

FREE for GCMA Members and invited guests.

To request one of the limited places write: events@gulfbondsukuk.org

Featured Speakers:

. Charbel Azzi, Head of Middle East, Africa & CIS, S&P Dow Jones Indices

. Martin Haycock, Senior Product Specialist, Convertible Bonds, Fisch Asset Management

Discussion Topics:

. A brief history of indices; growth in use and number of indices

. Development of GCC indices and GCC inclusion in global indices

. Impact and benefits of GCC indices inclusion

. Regulatory changes in index management and shifts in index ownership

. Case study: convertible bond indices

. S&P Global Sukuk and MENA Bond and Sukuk indices

. New High Yield Global and GCC Sukuk indices

. Pan Arab Multi-Asset/Balanced indices

. Overview of S&P DJI’s regional Conventional and Shariah Equity indices

. Inclusion of Saudi Arabia in the S&P Emerging Markets Core Index

![]()

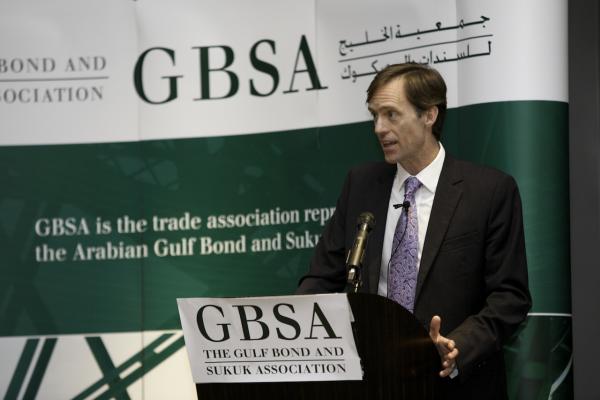

GCMA 2018 Gulf Debt Capital Market Summit

29/10/2018

The conference presentations are now available!

Anita Yadav, Emirates NBD, “GCC Bonds and Sukuk”

Jan Friederich, Fitch Ratings, “Gulf States in the EM Universe”

Mohamed Damak, S&P Global Ratings, “Sukuk Market Update”

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants for the Gulf Debt Capital Market Summit in Dubai, United Arab Emirates on the 29th of October 2018.

The event is complimentary to GCMA members. Non-members wishing to attend should contact: events@gulfbondsukuk.org

The Event Program is now available for download!

Hear directly from key global and regional investors and issuers as well as as they debate:

- Gulf States in the EM Universe – Reform Efforts, Oil Prices & Sovereign Wealth

- Indexing the region – Impact of Inclusion and future outlook for indices

- In which markets and formats will the sovereigns issue?

- How technology may be set to fundamentally reshape the debt markets

- Will the surge in Sukuk issuance be sustained?

- Innovations and Trends that will shape the Middle East Bond Markets

- Is there room for ESG investing in regional debt markets?

- Why public debt management will make all the difference

- Putting the Bond and Sukuk Regulations to work – Establishing precedent and a track record

Confirmed speakers already include:

Senior Representatives of the Gulf Region’s Capital Market Regulators

Senior Representatives of the Gulf Region Debt Management Offices

Bryan Stirewalt

Chief Executive, Dubai Financial Services Authority

H.E. Dr. Obaid Al Zaabi

Chief Executive Officer, Securities and Commodities Authority

Mohammed Al Abri

Vice President Capital Markets, Capital Market Authority, Oman

Faisal Sarkhou

Chief Executive Officer, KAMCO Investment Company

Jan Friederich

Head of Middle East & Africa (MEA), Sovereign Ratings, Fitch Ratings

Richard Clode, CFA

Portfolio Manager, Global Technology Strategy, Janus Henderson Investors

Andy Cairns

Head of Global Corporate Finance, First Abu Dhabi Bank

Anita Yadav

Senior Director and Head of Fixed Income Research, Emirates NBD

Dr. Mohamed Damak

Director, Global Head of Islamic Finance, S&P Global Ratings

Alex Roussos

Partner, Dentons

Amit Ramchandani

Director, High Yield Product Group, Standard Chartered Bank

Omar Zaineddine

Senior Vice President and Head of Investment Banking Department, KAMCO Investment Company

Stephen Yeats

Head of Fixed Income, Cash and Currency, EMEA, State Street Global Advisors

Anthony Belcher

Head of ICE Data Services (EMEA), Intercontinental Exchange

Parth Kikani, CFA

Director, Fixed Income, Emirates NBD Asset Management

Khalid Howladar

Managing Director, Acreditus

Abdul Kadir Hussain

Head of Fixed Income Asset Management, Arqaam Capital

Mohsin Shaik bin Sehu Mohammed

Senior Executive Manager, Investment Banking & Capital Markets, Maisarah Islamic Banking Services, Bank Dhofar

Nikolaos Passaris

Head of Treasury Front Office, Majid Al Futtaim (MAF) Holding

Basil Al-Jafari

Counsel, Latham and Watkins LLP

More great speakers to be announced.

Platinum Sponsors

Gold Sponsors

Reception Sponsor: Kuwait International Bank (KIB)

Annual Conference Of The Securities And Commodities Authority 2018 and The First Arab Financial Intermediaries Conference

10/04/2018

Topics:

Regulatory Framework: Role of Regulators to Develop Capital Markets

Impact of Financial Technologies on Capital Markets

Foreign Investment and Post Trade Transparency

Arab Financial Markets: Building Capacity

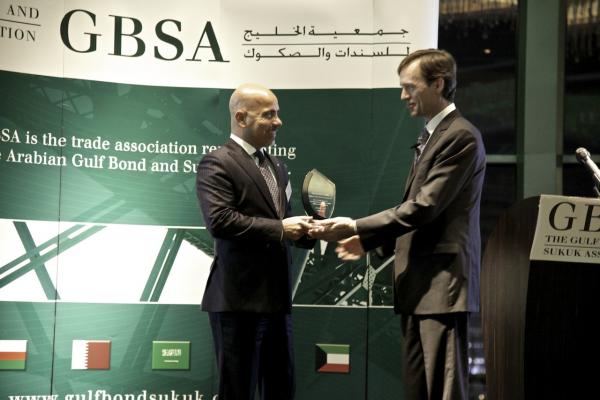

Sukuk Morning Symposium

08/04/2018

CFA Society Emirates, the Emirates Securities and Commodities Authority, and The Gulf Capital Market Association (GCMA) have the pleasure of inviting you to the following upcoming event.

The Securities & Commodities Authority (SCA), The Gulf Capital Market Association (GCMA) and CFA Society Emirates have partnered to deliver a short conference on Sukuk.

The Sukuk market has been growing rapidly with an increasing number of large and liquid issues recently. The origins of Sukuk may lie in the Islamic world, but the reach of these funding instruments is increasingly becoming global. The purpose of this event is to provide an insight into the benefits and challenges inherent in Sukuk issuance, investing and trading.

Agenda

9:30 am: Registration and welcome coffee

10:00 am: Brief introduction by representatives of GCMA, SCA, CFA Society Emirates

10:10 am: Presentation on Global and Regional Sukuk markets by Ebru Boysan (Bloomberg)

10:35 am: Presentation on Sukuk mechanics by Khalid Howladar (Acreditus): “Understanding Sukuk complexity and recent market challenges”

11:00 am: Experts panel discussion moderated by Michael Grifferty (GCMA)

11:45 am: Q&A

12:15 pm: Light lunch

April 2018 GCMA Oman Debt Capital Markets Conference

01/04/2018

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants for the GCMA Oman Debt Capital Markets Conference in Oman on the 18th of April 2018.

This is the only Oman conference created by the industry and presented with the cooperation of its official partners.

A full list of speakers and detailed agenda will be released shortly. Speakers already confirmed include:

H.E. Abdullah Al-Salmi – Executive President, Capital Market Authority, Sultanate of Oman

Sohail Niazi – Chief Executive, Maisarah Islamic Banking

Samra Al-Harthy – Senior Manager, Economic Research, State General Reserve Fund, Ministry of Finance, Sultanate of Oman

Sadaf Buchanan – Partner, Dentons

Elina Mohamed – General Counsel, Orpic

Vinod Sadhwani – Senior Manager, Corporate Finance, NAMA Holding Company

Mohsin Shaik Bin Sehu Mohammed – Senior Executive Manager, Investment Banking & Capital Markets, Maisarah Islamic Banking

Kemal Rizadi Arbi – Expert/Advisor, Capital Market Authority, Sultanate of Oman

Asad Qayyum – Senior Associate, Al Busaidy, Mansoor Jamal & Co

Sean Johnson – Partner, White & Case LLP

Abdul Kadir Hussain – Head of Fixed Income Asset Management, Arqaam Capital

Khalid Howladar – Managing Director, Acreditus

Giuseppe Ruggiero – Managing Director, Debt Capital Markets, First Abu Dhabi Bank

This event is complimentary to GCMA members. Non-members wishing to attend should contact: events@gulfbondsukuk.org

Platinum Sponsor: Maisarah Islamic Banking

Gold Sponsor

Members’ Luncheon Roundtable with Federal Reserve Bank of New York delegation

06/02/2018

GCMA will host a members-only luncheon roundtable with a delegation from The Federal Reserve Bank of New York. Members to contact events@gulfbondsukuk.org

GCMA 2018 Kuwait Debt Capital Markets Conference

29/01/2018

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants for the GCMA Kuwait Debt Capital Markets Conference in Kuwait on the 8th of March 2018.

This is the only Kuwait conference created by the industry and presented with the cooperation of its official partners.

A full list of speakers and an agenda will be released shortly. Confirmed speakers include:

Faisal Sarkhou – Chief Executive Officer, KAMCO Investment Company

Mubarak AlRefaei – Acting Head, Supervision Sector, Capital Market Authority, State of Kuwait

Bilal Khan – Senior Economist, MENA and Pakistan, Standard Chartered Bank

Alex Roussos – Partner, Dentons

Khalid Al Rukhayes – Senior Dealer, Kuwait Finance House

Rani Selwanes – Managing Director, Head of Investment Banking, NBK Capital

Khaled Fouad – Chief Investment Officer, KAMCO Investment Company

Fawaz Abusneineh – Managing Director, Head of Debt Capital Markets & Issuer Services, First Abu Dhabi Bank

Hossam Abdullah – Legal Counsel & Managing Partner, Al-Hossam Legal

Omar Zaineddine – Senior Vice President, Head of Investment Banking, KAMCO Investment Company

Alex Saleh – Partner, Al Tamimi & Co

Declan Sawey – Group Treasurer, Kuwait Projects Company (KIPCO)

Rasha Othman – Senior Vice President, Investment Banking, Kuwait Financial Centre “MARKAZ”

Yasmine Salamah – Assistant General Manager, Corporate Banking, Al Ahli Bank of Kuwait

Hear directly from the region’s regulators as well as key global and regional investors and issuers as they discuss:

- Kuwait/GCC regional economic outlook

- The future of Kuwait as a major regional market

- Financing oil and gas projects

- Challenges and opportunities with Sukuk

- Perspectives on Kuwait sovereign issuance

- Introducing more structured products into the market

- Growing the KD bond and sukuk market

Registration is now closed.

Platinum Sponsor: KAMCO Investment Company

Gold Sponsor

MENA Fixed Income ESG Roundtable

02/01/2018

GCMA invites interested members to take part in a roundtable of ESG investing in our fixed income market from 4:00 to 5:00 PM (UAE/Oman) on Monday, January 15 at the office of S&P Global in Dubai. Places are limited.

Justin Sloggett, Head of Public Markets at UN Principles for Responsible Investment (UNPRI) initiative will be at the meeting to present the PRIs activities and the current state of play in other markets.

Draft Agenda:

- Introduction to the PRI initiative and activity in MENA

- Stocktaking of ESG in GCC bond and sukuk market

- Why (or why not) the bond/sukuk community should integrate ESG into decision-making?

- How can ESG can become part of the investment process?

- What can GCMA do as a collective?

PRI/CFA Institute ESG Workshop and Panel Discussion

14/12/2017

CFA Institute and the PRI are hosting series of workshops across the globe that will culminate in regional reports on the current state of ESG integration.

Those invited to the workshop have been carefully selected to ensure that there is a good representation of the different players in the financial markets. The format of the workshop will be group discussions with four to eight groups discussing the impact of ESG integration on investment processes, investment decisions and financial markets.

The discussions will be centred around a survey, which we would like you to fill out before the workshop. It will take roughly ten minutes to complete and your answers will remain anonymous. When filling out the survey, please provide your views on ESG integration, not your firm’s views on ESG integration. We will feed all responses into the regional reports mentioned above.

The workshop will be followed by a panel discussion: A Practitioners View: ESG, Islamic Bonds, Green Bonds: “What investors need to know”.

Moderator:

Justin Sloggett, CFA, Head of Public Markets, Principles for Responsible Investment

Justin joined the PRI in June 2014. He oversees the Listed Equity and Fixed Income work streams. Before starting at PRI, Justin had worked for the Co-operative Asset Management as a Responsible Investment Analyst, where he was responsible for ESG integration and worked closely with the investment research team and the portfolio managers. Justin has also worked for F&C Asset Management PLC as an Investment Support Analyst. Justin graduated from the University of Nottingham with a Master’s degree in Mechanical Engineering and is a CFA® charterholder.

Panelists:

Fawaz Abusneineh, CFA , Managing Director, Head of Debt Capital Markets & Issuer Services, FAB

, Managing Director, Head of Debt Capital Markets & Issuer Services, FAB

Fawaz is in charge of the DCM Origination business for FAB’s Global Corporate Finance clients. He has worked on a number of landmark transactions for high profile issuers in the Corporate, Institutional and SSA space, covering various DCM products from plain vanilla bonds and setting up MTN Programs, to project bonds, hybrid capital and liability management, both conventional bonds and Islamic (Sukuk). In addition, Fawaz manages the Issuer Services business for FAB’s corporate and institutional clients

within the UAE, offering Registrar and Securities Services in the equity and fixed income space. Fawaz has also originated and overseen the execution of numerous landmark deals outside the region, including the inaugural sovereign Sukuk issuance from HM Treasury and Hong Kong Government SAR. Prior to this role, Fawaz headed NBAD’s global distribution of Syndicated Loans and also managed NBAD’s Proprietary fixed income portfolio of c. USD 1.25bn. Fawaz holds a BSc (Hon’s) in Accounting & Finance from the London School of Economics and is a holder of the Chartered Financial Analyst ® designation. He is also the Chairman of the Middle East Region for International Capital Market Association (ICMA) and a Board Member of The Gulf Bonds and Sukuk

Association (GCMA).

Debashis Dey , Capital Markets and Islamic Finance Partner, White & Case

, Capital Markets and Islamic Finance Partner, White & Case

Widely recognised as a leading finance and capital markets lawyer, Debashis helps domestic and international clients to execute a spectrum of complex transactions including limited recourse infrastructure, project finance and ethical finance (green finance, Islamic finance). White & Case is a leading law firm in ethically and socially responsible finance innovations and has acted on transactions such the Polish Green Sovereign bond.

Debashis’ extensive track record includes advising investment banks, corporates and governments on capital markets, securitisation and structured finance matters, including Islamic finance and conventional finance. Noted for the pioneering dimension to his work, Debashis has led numerous product innovations in Europe and the Middle East involving multilaterals, export credit agencies, Sovereigns and Government related sponsors. Debashis is qualified in England and Wales and New York.

Dr. Ashraf Gamal El Din, Chief Executive Officer, Hawkamah

Dr. Ashraf Gamal El Din is the Chief Executive Officer of Hawkamah, the Institute for Corporate Governance. Prior to joining Hawkamah, Dr. Ashraf was the Executive Chairman of Egypt Post. He conducted major governance and organizational restructuring of the Post and its subsidiaries. These reforms resulted in massive transformation of the Post performance and profitability. Before that, he was the Deputy Executive Director of the Egyptian Banking Institute, the training arm of the Central Bank of Egypt. He was also the founder and Project Manager of the Egyptian Corporate Responsibility Center working on promoting the concepts and application of CSR among state owned and private companies in Egypt. Furthermore, he was the Executive Director of the Egyptian Institute of Directors (EIoD), the Institute of Corporate Governance in Egypt and the Arab Region Dr Ashraf served as a board member and head of the Audit Committee in a number of listed, non-listed, State Owned and family owned companies. He also served a member of the General Assembly of the Holding Company for Transportation.

Dr. Ashraf was the advisor of the Minister of Investment 2005-2011, where he was in charge of the restructuring of SOEs, their governance and boards. Furthermore, Dr. Ashraf is an Associate Professor of Management, Faculty of Commerce, Cairo University and holds a PhD degree from Manchester University, UK, and a Master’s degree in Public Administration from Carleton University, Canada. He further holds a Bachelor degree in Business Administration from Cairo University with highest honor. Dr. Ashraf worked as head of Business Administration Department at Nile University for Graduate Studied, affiliated with the Ministry of Communication & Information Technology. Since 1997, he taught a large number of management and business courses in Egypt, the US, and the Gulf Area

Damian Regan, Director, Insurance and Investment Management, PwC

Damian is PwC’s Middle Eastern Trust and Transparency Solutions leader based in Dubai and assists clients in their identification, collation and presentation of information to external stakeholders, where he provides operational controls reporting, investment track records and corporate social responsibility reporting and assurance. He moved this summer to Dubai from PwC UK where he was based in our London office and ran a similar solution focused on the Financial Services industry.

One of his key areas of focus is Green Finance, particularly the assurance of whether assets have been invested and whether they are in line with the mandate of the fund. He has worked with HSBC, the Bank of America and the UK’s Green Investment Bank amongst others in this area.

Damian also oversees a wide range of other non-financial reporting and assurance engagements and has worked with a number of organisations such as the Principles of Responsible Investment, The Chartered Financial Association’s Global Investment Performance Standards, The Climate Bond Initiative, The City of London’s Climate Change Initiative and The Equator Principles, to help develop and promote Standards of reporting across a wide spectrum of publicly reported information. He has recently been invited to join the UAE Clean Energy Business Council’s Green Finance and Sukuk Bond Committee.

Damian has spoken at a number of conference across the Middle East with the CFA Society, United Nations Development Program, the Clean Energy Business Council and the IIA Chief Auditor Executive Conference.

Workshop Co-ordinator:

Matt Orsagh, CFA, Director, Capital Markets Policy, CFA Institute

GCMA/EMTA Special Seminar on MENA/GCC Markets in London, UK

07/12/2017

GCMA/EMTA SPECIAL SEMINAR ON THE MENA/GCC MARKETS

Sponsored by:![]()

Wednesday, January 31, 2018

International Institute for Strategic Studies

6 Temple Place

London, WC2R 2PG

3:15 p.m. Registration

3:30 p.m. Keynote Address

The Dana Gas Case: An Update and Implications for Sukuk Market

Debashis Dey

Partner, White & Case

4:00 p.m. Panel Discussion

Current prospects for the MENA/GCC Bond Markets

Alia Moubayed (International Institue for Strategic Studies)

Marcel Kfoury (Bluecrest Capital)

Tim Gill (Fidelity Investments)

Christopher Watson (Finisterre Capital)

Kaushik Rudra (Standard Chartered Bank)

5:00 p.m.

Cocktail Reception

Additional Support Provided by Standard Chartered Bank

———————————————————————————-

Attendance Fee for GCMA Members: US$50. Non Member US$695.

GCMA members can register for this event through the EMTA registration portal.

Please CLICK HERE

You will be asked to create a login based on your email address, after which you can immediately register for the event using the GCMA Member Rate.

Please contact us on events@gulfbondsukuk.org for more information.

World Islamic Banking Conference

22/11/2017

Join H.E. Rasheed Mohammed Al Maraj, Governor, Central Bank of Bahrain and over 1300 of the biggest minds in Islamic Banking & Finance congregate for what is the event of the year at the 24th World Islamic Banking Conference –convened by Middle East Global Advisors in strategic partnership with the Central Bank of Bahrain – where they will discuss key topics gravitating around the theme of “Drivers of Economic Growth & Risks: Policymakers & Regulators”.

Register Now to hear insights from Adnan Ahmed Yousif, Chief Executive and President, Al Baraka Banking Group; Taliya Minullina, Chief Executive of the Tatarstan Investment Development Agency & Member of the Investment Council of the Republic of Tatarstan; Adel Abdul Wahab Al-Majed, Vice-Chairman & Chief Executive Officer, Boubyan Bank; Abdulla Mohammed Al Awar, CEO, Dubai Islamic Economy Development Centre; Abdelilah Belatik, Secretary General,General Council for Islamic Banks and Financial Institutions (CIBAFI), Abdul Hakeem Alkhayyat, Managing Director & CEO, KFH Bahrain; Hassan Amin Jarrar, CEO, Bahrain Islamic Bank, Ayman Sejiny, CEO, IbdarBank and other distinguished Islamic finance veterans from across 50 countries, who will shape the future discourse of the Islamic Finance industry.

What lies in store for you at the 24th WIBC? Governors’ Addresses; High-profile Regulatory Debate among Central Bankers; CEO panel on growth and profitability; Digital banking-focused Panel on harnessing digital technologies to stay relevant; Discussions on Sukuk vs Bonds, VAT, Financial Inclusion, Regional Economic Outlook, Sustainable Investing & more; Exclusive WIBC Knowledge-Sharing Series focusing on topical issues like aviation financing, renewable energy financing, halal ecosystem; WIBC Gala Dinner and Performance Awards & Exclusive launch of Financial Intelligence Reports.

To download the Conference Brochure for the 24th WIBC, click here

Gulf Bond & Sukuk Association Members can avail a discount of 20% using the code GCMA20 by registering here

For partnership and speaking opportunities, drop an email to: partnerships@meglobaladvisors.com

For more details, visit the website

ACT Middle East Annual Summit

29/10/2017

The region’s largest and most established networking event for treasury and corporate finance professionals returns to Dubai on 21-22 November.

Now in its eighth year, the ACT Middle East Annual Summit is the largest and most popular treasury event in the GCC. Uniting the region’s leading corporates, you can expect to meet over 500 treasury and finance professionals, hear thought-provoking insights and best practice from over 60 speakers and talk business with leading product and service providers, all under one roof.

2nd Middle East and North Africa Pensions Conference

12/10/2017

In a world where traditional retirement, funded by the state, and defined-benefit pensions are increasingly under pressure, what kinds of solutions are available? The 2017 MENA Pensions Conference will examine success stories and the experience of public-private pension formats, which help balance pension risks between the two sectors. The conference will also seek to answer the question, “What are the best vehicles and asset mixes for long-term savings and investments?” This year’s program covers pension scheme design and administration, asset management, and operational technology, and will include a mini-exhibition of pension technology and specialist applications.

Institute of International Finance (IIF) Islamic Finance Roundtable

14/09/2017

GCMA will be attending the Institute of International Finance (IIF) roundtable in Washington D.C. GCMA members are encouraged to register by contacting Wolfgang Engel at wengel@iif.com or by contacting GCMA at events@gulfbondsuk.org

Clean Energy Finance Workshop: Green Bonds & Sukuk and Crowdfunding Cleantech

03/08/2017

One of the largest barriers to clean energy deployment is access to capital and investment. Governments throughout the GCC and MENA region are setting ambitious clean energy and energy efficiency targets. Compounding the difficulty of achieving these targets, the population of the GCC is expected to grow to over 53 million by 2020, a 30% increase over the population in 2000, making the GCC one of the fastest growing regions in the world. Such a population growth trajectory will create an unprecedented rise in demand for energy, water, transport, urban development and infrastructure. Substantial amounts of investment will be required in order to finance the clean energy and energy efficiency projects necessary to meet the needs of the future population.

This workshop will focus on two platforms for financing clean energy projects:

Green bonds are not only becoming an attractive financing option, but are also attracting project developers to raise capital for their projects, assets and other activities to showcase their responsible approach toward business. Given the growth of the Islamic finance industry, a green Sukuk that funds these projects in compliance with Shariah law is the obvious next step.

Crowdfunding has provided a new way to eliminate third parties, and provide energy and monetary benefits to investors. The benefits of crowdfunding aren’t restricted only to developed economies; in some ways, they may be even more important for countries without well-developed financial infrastructures. Now that renewable energy technology is becoming viable and cost-effective, firms in the industry are turning to crowdsourcing as a means of attracting capital.

GCMA Debt Capital Markets Summit 2017

02/07/2017

The Gulf Capital Market Association (GCMA) will gather investors, issuers, regulators and market participants for the Gulf Debt Capital Market Summit in Dubai, United Arab Emirates on the 6th of November 2017.

This is the only conference created by the industry and presented with the cooperation of its official partners.

A full list of speakers and an agenda will be released shortly. Confirmed speakers include:

H.E. Mohammed El-Kuwaiz

Chairman, Saudi Arabia Capital Markets Authority

H.E. Dr. Nayef Al-Hajraf

Chairman (of the Board of Commissioners) and Managing Director, Kuwait Capital Markets Authority

H.E. Dr. Obaid Al-Zaabi

Acting Chief Executive Officer, Securities and Commodities Authority

H.E. Sheikh Abdullah Al-Salmi

Executive President, Oman Capital Markets Authority

Dr. Jihad Azour

Director, Middle East & Central Asia Department, International Monetary Fund

Rachel Harris

Client Portfolio Manager, Janus Henderson Investors

Kevin Murphy

Group Treasurer, Kanoo Group

Hear directly from the region’s regulators as well as key global and regional investors and issuers as they discuss:

- The future of the Gulf as a major emerging market

- Financing the transformative infrastructure of tomorrow

- Shifting the financing environment for companies and governments

- Putting new structures to work for issuers and investors

- How more liquidity can be generated

- Legal challenges to Sukuk

This event is complimentary to GCMA members. Non-members wishing to attend should contact: events@gulfbondsukuk.org

For more information, please contact events@gulfbondsukuk.org

September 2016, GCMA Debt IR Panel at MEIRS Annual Conference

Fisch Asset Management – GCMA Convertible Bonds Roundtable

09/05/2017

Fisch Asset Management will lead a discussion of convertible bonds as a funding tool and asset class for GCC companies and investors.

GCMA Capital Market Structured Finance Committee Meeting

Regularly scheduled meeting of GCMA’s Capital Market Structured Finance Committee.

GCMA – Environmental Finance Green Bond and Sukuk Roundtable

The Gulf Capital Market Association and Environmental Finance, in partnership with Latham & Watkins, the London Stock Exchange and S&P Global, will hold a thought leadership round table to discuss the development of the green bond and green sukuk market in the Middle East. The aim of the round table is to assemble some of the region’s leading figures to discuss the evolution of this exciting asset class, and the various methods that can be employed to grow it.

![IMG_20190723_095742476[2] IMG_20190723_095742476[2]](https://www.gulfcapitalmarket.org/wp-content/uploads/2019/07/IMG_20190723_0957424762-600x400.jpg)