Bond market a must for the Middle East

Wednesday, 10 March 2010

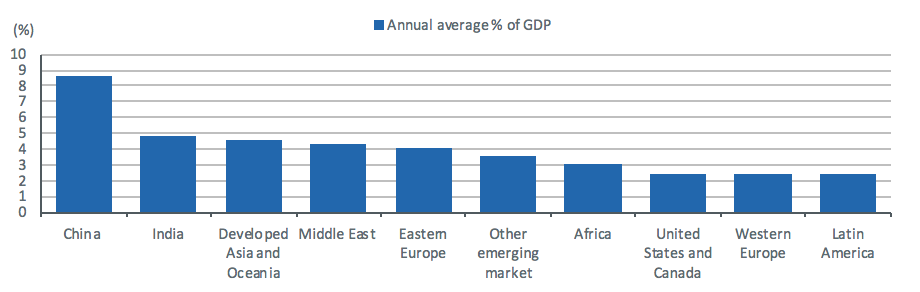

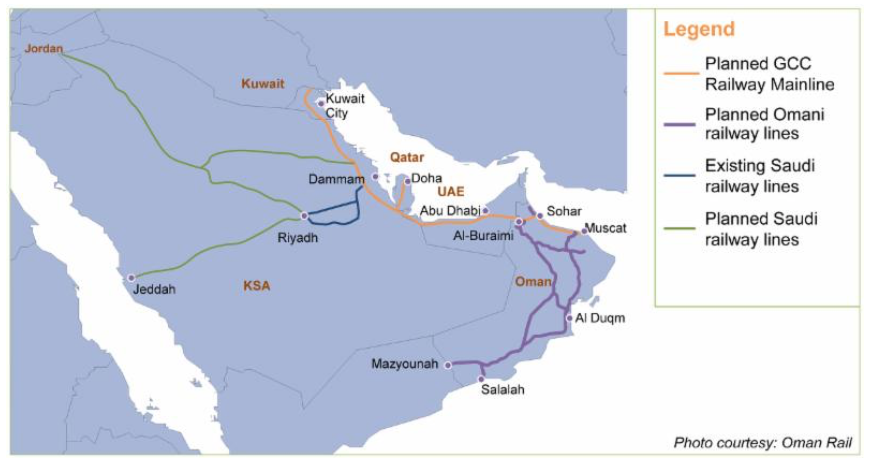

The Middle East will need a vibrant bond market as it continues to invest in infrastructure. Utpal Bhattacharya argues that some of the pain of over-leverage could have been reduced had the region had a strong secondary debt market to fall back on during the financial and economic crisis.

These are extraordinary times, and such times call for extraordinary ideas and thinking outside of the box for solutions. Much is uncertain, with businesses having built large holes in their books, cash flows having gone for a burton and employees deserting companies. Small businesses are near collapse, as the velocity of money and bank credit growth have slowed down considerably. The doubt around Dubai’s debt problem is also affecting business sentiments. Overall, there has been little good news, and even the news of a new oil find in Dubai did not have the power to lift chins.

What’s to be done, then? Many suggest patience until agreements between borrowers and lenders are reached in Dubai so that we can move on from the current freeze and get down to doing business. Sources say that a Deloitte team is now camped in Dubai to look at ways of restructuring the debt that certain entities in the emirate owe to global lenders. It is inevitable that sentiments will recover once we hear the outcome in the weeks or months ahead.

In the meantime, however, there have been significant positive developments in the UAE, some of which have gone unnoticed because of the media’s tendency to follow the headline developments. One such positive development was the launch of The Gulf Capital Market Association (GCMA), while the listing for the first International Finance Corporation’s Islamic bond or sukuk on Nasdaq Dubai was a milestone.

We should also not underestimate the amount of work undertaken by Dr. Nasser Saidi, chief economist at the Dubai International Financial Centre (DIFC), and his team in the economic note titled: “Local Bond Markets as a Cornerstone of Development Strategy”. It is a very well written, comprehensive report on the way forward for the UAE and the region to establish a dynamic and vibrant bond market that would allow for both accessing alternative capital for governments and corporates and also help in managing money more efficiently when it comes to the role of regional central banks. This report should form the basis of furthering the idea of a debt market to the next level. It is quite significant that the financial industry has taken the lead to form an association. One can only hope that the association will be able to push the agenda vigorously.

The bond association

Although the above is a hypothesis, it may well prove right if tested as a pilot scheme first. One thing to note about RIBs is that India’s rating was below investment grade at the time of the issuance of the RIBs by the State Bank of India, and the bonds had no ratings. From the successful issuance of the RIBs, it is evident that investors do not always look at ratings, but rather bet on the future and sometimes go by their gut feelings, especially in emerging economies.

While an issuance like RIBs could be a good idea to deal with these extraordinary times when liquidity is difficult to come by, the long-term plan should be to develop a wide and deep debt capital market with local currency issuances focusing on institutions, as typically bond markets are institution driven. To be unable to issue debt papers because of the lack of a vibrant secondary bond market is not a viable option anymore for Dubai, the UAE or the region itself, as all continue to grow and build quickly. That’s why the creation of the GCMA should be regarded as a milestone in the development of the region’s capital market. With the industry having taken the responsibility on its own shoulders, the rest should follow.

GCMA president Michael Grifferty, who has the responsibility of engaging various stakeholders to develop a regional bond market, says that the association will harness the commitment of its members to promote a wide and deep market on the basis of international best practices as adapted to the region, governed by the highest ethical and professional standards and a shared sense of purpose.

The association is chaired by senior HSBC banker Andrew Dell. Some of the members of the GCMA are HSBC Middle East, Mashreq Capital, Standard Chartered Bank, National Bank of Kuwait, BNY Mellon, Citibank, First Gulf Bank, QInvest, Al Bashayer, Standard and Poor’s, Moody’s Middle East, DIB Capital, Barclays Bank and Emirates NBD.

Grifferty adds that the GCMA’s intention is to make the association very inclusive. Going forward, it will have law firms, asset managers and everyone who will play a role in the market.

“It is not surprising that most of our members are large banks who could be issuers or underwriters of bond issues. But going forward, we will be a very inclusive association with all stakeholders as members. Our aim is to enable an active regional secondary market for bonds; that is much harder than creating a primary market,” says Grifferty.

The main activities of the bonds association will include engaging the government and the regulators and helping to create a regulatory framework, which is essential for a bond market. Grifferty notes that awareness creation will also be part of the association’s focus

“We are already reaching out to regulators, fiscal and monetary, across the Gulf countries. We have actually consulted and have given our inputs into the DIFC’s white paper on bond markets. We hope to have that kind of dialogue with any and every kind of market and regulator in the region,” he says.

Challenges

While the creation of the GCMA by the industry should act as a catalyst in the creation of the regional bond market with an active secondary market, there is much work left to be done, including bringing insurers, pension funds, governments, treasury managers, central bankers and regulators into the market or the scheme of things.

The DIFC white paper on bond markets quotes four major reasons that can hinder the development of an efficient local currency bond market, including macroeconomic stability. Narrowness of the local investor base is also an impediment, along with the lack of a proper regulatory framework.

The paper notes that although the GCC economies have generally experienced macroeconomic stability and have followed liberal market policies, the lack of a deep investor base and regulations are challenges.

“The GCC countries also lack additional important ingredients of a well-functioning debt capital market. There is little credit rating culture, unsatisfactory market transparency, lack of benchmarks, a dearth of long maturities, lack of a broad spectrum of institutional investors and the absence of a derivative market for managing interest rate and credit risk. Only recently a credit default swap OTC market has gained prominence, but it is still in its infancy,” it points out.

The paper also notes that high inflation rates in the developing economies undermine the demand of local currency paper. Greenwood, however, feels that high inflation does not count much for local currency issuances if the proceeds are to be used locally. The issuers could always compensate the buyers with better returns if the proceeds were to be used for local projects whose returns are higher.

Typically, a country with a pegged currency has two types of inflation. The first is the imported inflation from the country to which the local currency is pegged. The second is the inflation coming from the rise in the price of non-traded goods like rents. Since developing countries tend to grow faster, the price rise of non-traded goods is much higher than the developed country to which the local currency is pegged, adding to the inflation.

“It will be more expensive in nominal terms to borrow in local currency in developing countries that have pegged currencies, but if the proceeds are used locally, then they should still make a positive return,” Greenwood argues. But building a dynamic bond market that has both international and local currency issuances, as well as a strong secondary market and a retail presence, is not something that can happen overnight. A bond market is also not the panacea for developmental problems, as ultimately growths of companies or economies have to be managed properly.

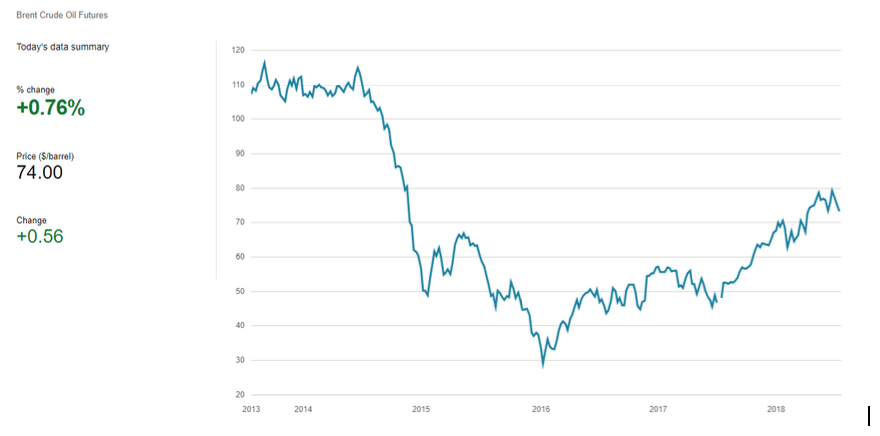

And being over-leveraged through any type of debt – bank loans or bonds – is not a good position to be in. However, long-term debt is more acceptable than short-term debt when it comes to investing in infrastructure and managing growth. In fact, the biggest challenge for Dubai and the rest of the region was when global cross-border capital flows dropped 82 per cent in 2008 to just US$1.9 trillion from US$10.5 trillion in 2007 and banks stopped lending and refinancing debt.

That’s where a debt market with a strong secondary market could have been helpful for the region. At present, bank assets in the Middle East and North Africa region account for 85 per cent of all assets, while stock market capitalisation is 12 per cent and debt securities are just three per cent (IMF figures). In the world market, debt securities account for 42 per cent, while bank assets are 33 per cent and stock market capitalisation accounts for 25 per cent.

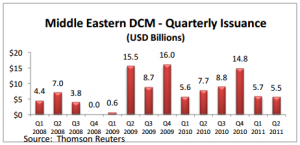

While it will still take many years for the region to get the right asset mix, especially compared to the world market, the immediate challenge for the GCC and the Middle East is to have the regulation, the awareness and the right platform in place for a flourishing bond market. An earnest start has been made in the past decade with a primary market that has issued both sovereign and corporate bonds, both Islamic and non-Islamic, in the region. The next step should be to consolidate on these achievements and move the game to the next level.

It would also not be a bad idea, as Greenwood suggests, for regional central banks to start issuing certain debt papers regularly that could create some sort of a yield curve for the bond market to follow. With the monster of inflation eating into corporate earnings, households and savings, hurting the financial system and the economy itself in the recent past, such issuances would give the nascent bond market a boost and would also enable money supply and inflation to be managed more efficiently than before.